texas estate tax rate

51 rows The estate tax rate is based on the value of the decedents entire taxable estate. For tax year 2021 Benbrook maintains a property tax rate of 6175 cents per 100 valuation.

This means that any estates that are valued over 117 million dollars will be taxed before any assets are.

. That said you will likely have to file some taxes on. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate.

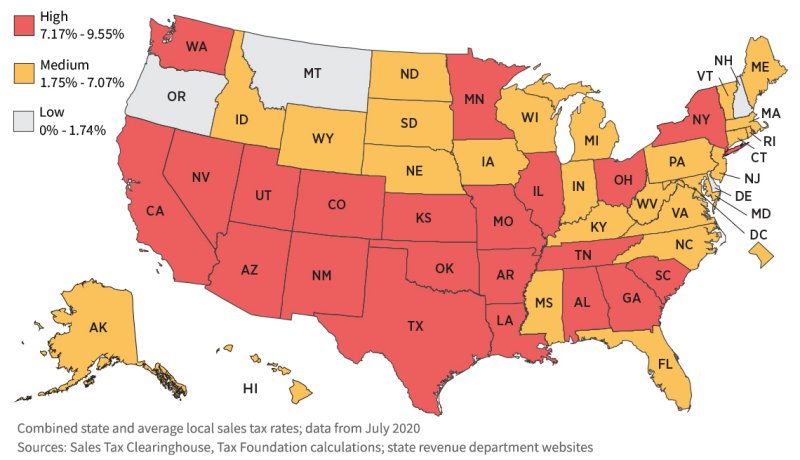

Rates include state county and city taxes. 12 rows In 2022 the federal estate tax ranges from rates of 18 to 40 and generally only applies to. The average property tax rate in Texas is 180.

2 The lowest tax rate for. View photos map tax nearby homes for sale home values school info. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

This is currently the seventh-highest rate in the United States. The latest sales tax rates for cities in Texas TX state. That 40 rate is the top tax rate and it only applies to families leaving behind more than 1 millionafter accounting for the lifetime gift tax exclusion.

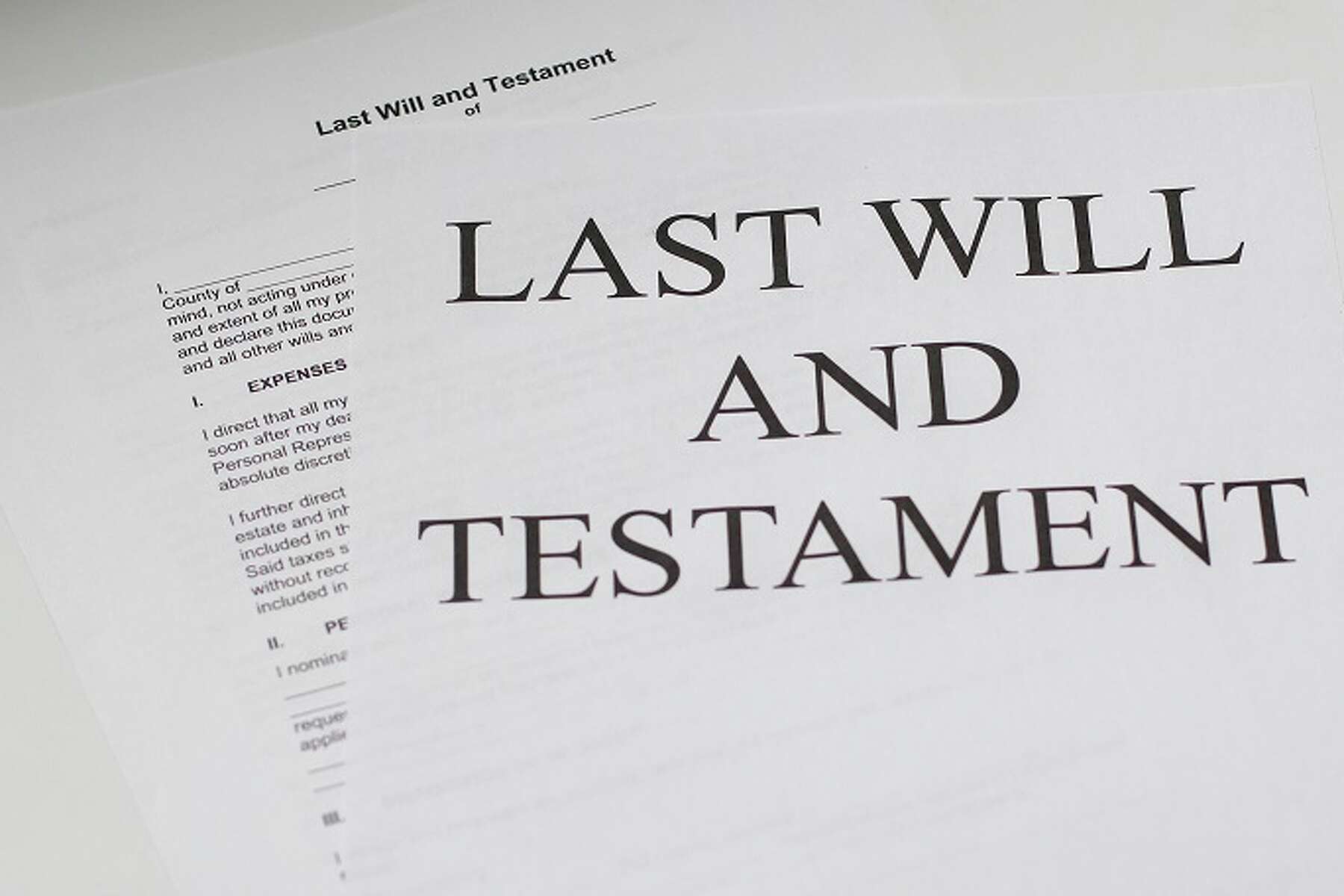

Harris County Commissioners Court voted this week to propose a property tax rate of 065260 just below the countys rollback or voter-approval rate. 4 5 Property Taxes in Texas. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

View photos map tax nearby homes for sale home values school info. In Dallas County Texas the property taxes get calculated through an assessed value of your property. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax.

Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. 2020 rates included for use while preparing your income tax deduction. There are no inheritance or estate taxes in Texas.

While Texas doesnt have an estate tax the federal government does. Median property tax is 227500. Each city will have a different tax rate.

The property tax in Texas averages an effective rate of 169 which is one of the nations highest marks. Is a property in TX. This is because the amount is.

Finally the state sales tax base is 625 but in most big Texan cities. Breaking this out in dollars if your home is valued at 200000 your personal. This interactive table ranks Texas counties by median property tax in dollars percentage of home value and percentage of median income.

Counties in Texas collect an average of 181 of a propertys assesed fair market. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Here is a list of states in order of lowest ranking property tax to highest.

The state repealed the inheritance tax beginning on Sept. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. The Estate Tax is a tax on your right to transfer property at your death.

For a 250000 home this. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. All property taxes are collected by the Tarrant County Tax AssessorCollector.

Real Estate Tax Rate. Is a property in TX. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

Dallas Property Tax Rate.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Texas Has Seventh Highest Property Tax Rate In U S Houston Agent Magazine

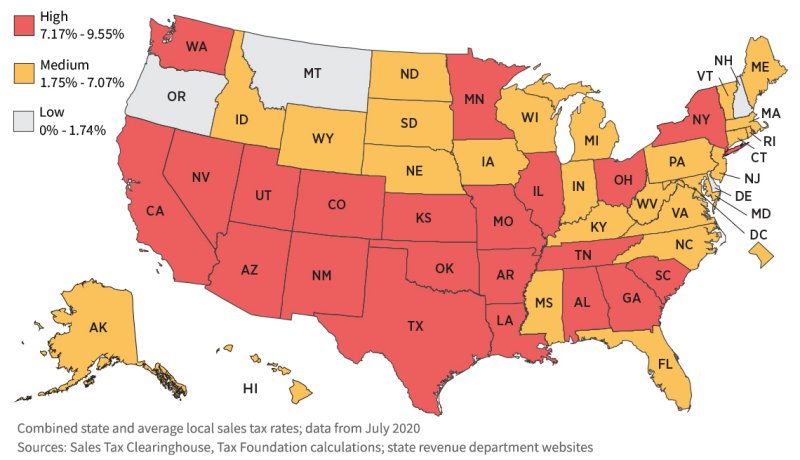

How Do State And Local Sales Taxes Work Tax Policy Center

Texas State Taxes Forbes Advisor

How Do State And Local Individual Income Taxes Work Tax Policy Center

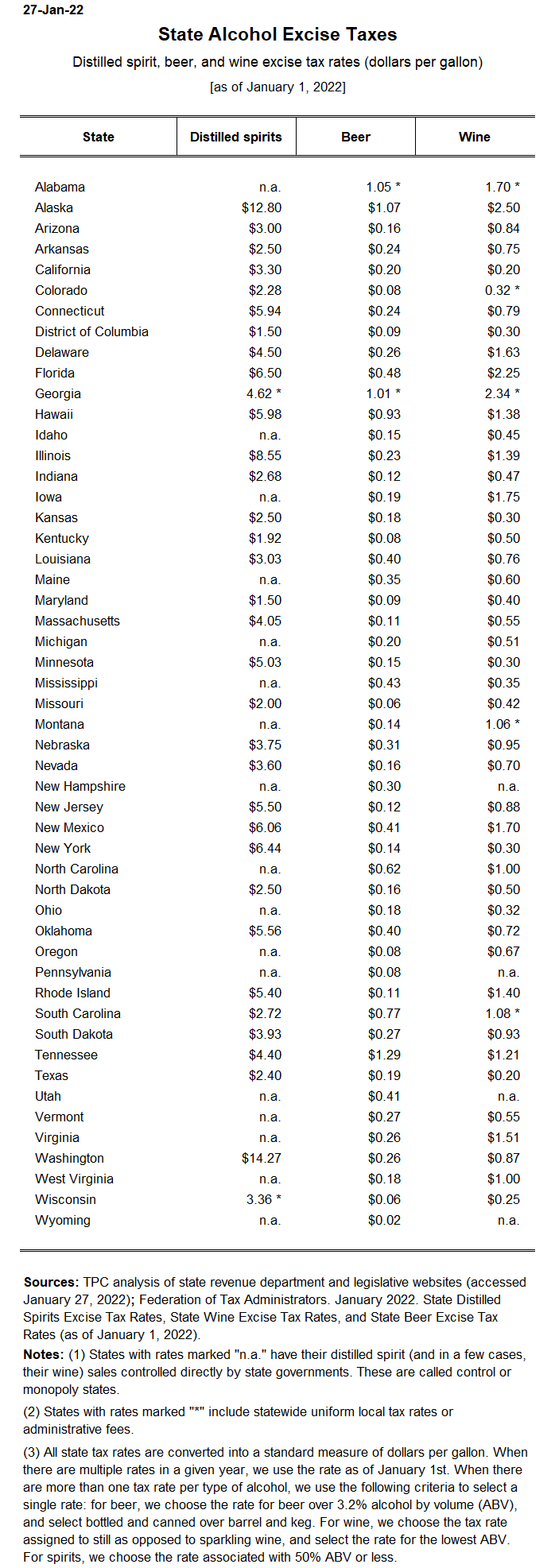

State Alcohol Excise Tax Rates Tax Policy Center

Do I Have To Pay Taxes When I Inherit Money

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas Retirement Tax Friendliness Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

Why Are Texas Property Taxes So High Home Tax Solutions

3 Reasons Why Is Property Tax So High In Texas Property Tax Tax Reduction Commercial Property